Stablecoins represent a unique category of digital assets designed to minimize price volatility by maintaining a stable value relative to a reference asset. Unlike traditional cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH), which experience significant price fluctuations, stablecoins are engineered to preserve a steady 1:1 peg—most commonly to fiat currencies like the US Dollar (USD), Euro (EUR), or even commodities like gold.

This stability makes them ideal for:

✅ Everyday transactions (like digital cash)

✅ Trading & hedging against crypto volatility

✅ Decentralized Finance (DeFi) applications

Whether you’re a crypto trader, DeFi enthusiast, or long-term investor, understanding stablecoins is essential for navigating digital finance.

What Are Stablecoins?

Definition & Mechanism

Stablecoins are cryptocurrencies pegged to stable assets like the US Dollar (USD), gold, or other fiat currencies. Unlike volatile assets like Bitcoin (BTC) or Ethereum (ETH), stablecoins aim to maintain a 1:1 value ratio with their underlying asset.

Types of Stablecoins

Biitland.com categorizes stablecoins into three main types:

-

Fiat-Collateralized (e.g., USDT, USDC)

-

Backed 1:1 by cash reserves in banks.

-

Most common and widely used.

-

-

Crypto-Collateralized (e.g., DAI)

-

Backed by other cryptocurrencies (like ETH) but stabilized via smart contracts.

-

Decentralized but more complex.

-

-

Algorithmic (e.g., UST – before its collapse)

-

No collateral; relies on algorithms to maintain peg.

-

Higher risk but potential for decentralization.

-

Why Stablecoins Matter in Crypto

1. Price Stability in a Volatile Market

Unlike Bitcoin, which can swing 10% in a day, stablecoins provide a safe haven during market downturns. Traders use them to:

-

Lock profits without cashing out to fiat.

-

Avoid exchange withdrawal delays.

2. Efficient Cross-Border Transactions

Sending stablecoins internationally is:

-

Faster than bank transfers (seconds vs. days).

-

Cheaper than wire fees.

-

Borderless (no currency conversion needed).

3. Fuel for DeFi & Yield Farming

Stablecoins are the backbone of Decentralized Finance (DeFi), enabling:

💰 Lending & borrowing (e.g., Aave, Compound).

🌾 Yield farming (earning interest on stablecoin deposits).

🔄 Liquidity provision in decentralized exchanges (DEXs).

Top Stablecoins (Biitland.com’s Analysis)

Some of the top stablecoins are as follows;

| Stablecoin | Type | Backing | Pros | Cons |

|---|---|---|---|---|

| Tether (USDT) | Fiat | USD Reserves | High liquidity, widely accepted | Controversial audits |

| USD Coin (USDC) | Fiat | Fully audited USD | Transparent, regulated | Centralized |

| DAI | Crypto | ETH-backed | Decentralized, DeFi-friendly | Complex stability mechanism |

| Binance USD (BUSD) | Fiat | USD (Paxos-issued) | Regulated, low fees | Limited to Binance ecosystem |

| TrueUSD (TUSD) | Fiat | Fully collateralized | Transparent, legal compliance | Lower adoption than USDT/USDC |

Biitland’s Verdict:

-

For trading? USDT & USDC (best liquidity).

-

For DeFi? DAI (fully decentralized).

-

For compliance? USDC & BUSD (regulated).

Risks & Challenges of Stablecoins

1. Regulatory Risks: The Growing Government Crackdown

Why Regulators Fear Stablecoins

Governments and financial watchdogs view stablecoins as potential threats to:

-

Monetary sovereignty (could replace national currencies)

-

Financial stability (systemic risk if widely adopted)

-

Illicit finance (money laundering, sanctions evasion)

Key Regulatory Actions

| Case | Details | Impact |

|---|---|---|

| SEC vs. Paxos (BUSD) | SEC declared BUSD an unregistered security (2023) | Binance had to wind down BUSD operations |

| New York AG vs. Tether | $18.5M fine for misrepresenting reserves (2021) | Increased scrutiny on USDT’s backing |

| EU’s MiCA Regulation | Strict rules for stablecoin issuers (2024) | Many stablecoins may exit European market |

Emerging Trends:

-

Stablecoin-specific legislation in US Congress

-

CBDC competition (governments pushing digital currencies)

-

Exchange delistings (e.g., Kraken dropping Tether in EU)

2. Collateral Risks: When Backing Fails

Fiat-Backed Stablecoin Dangers

Even “safe” stablecoins like USDT and USDC face:

-

Reserve transparency issues

-

Tether’s reserves included questionable commercial papers

-

Only USDC provides monthly audited reports

-

-

Counterparty risk

-

If holding bank collapses (e.g., Silvergate affected USDC in 2023)

-

-

Redemption halts

-

Circle froze $3.3B USDC during SVB bank crisis

-

Crypto-Backed Stablecoin Vulnerabilities

-

Overcollateralization isn’t foolproof

-

DAI nearly broke peg when ETH crashed 50% in a day (2022)

-

Requires 150%+ collateral (inefficient capital use)

-

-

Liquidation cascades

-

If collateral value drops too fast, loans auto-liquidate

-

3. Algorithmic Stablecoins: A History of Disasters

Why Algorithms Fail

These “uncollateralized” stablecoins rely on:

-

Seigniorage models (mint/burn mechanisms)

-

Dual-token systems (e.g., UST + LUNA)

-

Market psychology (demand must stay constant)

The TerraUSD (UST) Collapse: A Post-Mortem

Timeline of May 2022 Crash:

-

UST loses peg to $0.98 (May 7)

-

Panic selling begins (May 9)

-

Luna Foundation Guard drains $3B BTC reserves (May 10)

-

Death spiral: UST at $0.30, LUNA hyperinflates (May 12)

Key Failure Points:

-

Reflexivity trap (more UST redemptions → more LUNA printed → price drops further)

-

Weak attack resistance (whale dumped $285M UST to trigger crisis)

-

Faulty design (assumed perpetual demand growth)

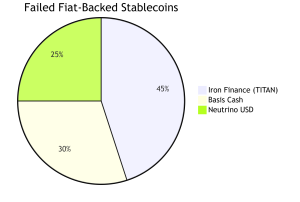

Other Algorithmic Failures

| Stablecoin | Crash Date | Cause |

|---|---|---|

| Basis Cash | 2021 | Never achieved peg |

| Neutrino USD | 2022 | WAVES token collapse |

| USDD | 2022 | Nearly lost peg during crypto winter |

4. Emerging Risks

New Threat Vectors

-

DeFi exploits (Curve pool hack affected crvUSD in 2023)

-

Sanctions compliance (Tornado Cash sanctions impacted DAI)

-

Interest rate risks (yield fluctuations affect demand

How Biitland.com Helps You Navigate Stablecoins

1. Real-Time Stablecoin News

Biitland covers:

-

New regulatory developments.

-

Audit reports (e.g., USDC’s monthly attestations).

-

Market trends (e.g., USDT dominance shifts).

2. Trading & Investment Strategies

-

When to switch from crypto to stablecoins.

-

Best yield farming pools for stablecoins.

-

Tax implications of stablecoin transactions.

3. DeFi Guides

-

How to stake stablecoins for passive income.

-

Risks of stablecoin lending protocols.

Future of Stablecoins: Biitland’s Predictions

🔹 CBDCs vs. Stablecoins – Central Bank Digital Currencies may compete.

🔹 More Regulation – Likely stricter KYC/AML rules.

🔹 Institutional Adoption – Hedge funds & banks using stablecoins for settlements.

Final Verdict: Are Stablecoins Safe?

👍 Pros:

✔ Stability in volatile markets.

✔ Fast & cheap global transfers.

✔ Essential for DeFi and crypto trading.

👎 Cons:

❌ Regulatory uncertainty.

❌ Collateral risks (if reserves aren’t transparent).

❌ Not FDIC-insured (unlike bank deposits).

Biitland’s Recommendation:

-

Use regulated stablecoins (USDC, BUSD) for large holdings.

-

Diversify across multiple stablecoins.

-

Stay updated via Biitland.com’s analyses.

FAQ: Stablecoins Explained

1. Are stablecoins really stable?

Most maintain a 1:1 peg, but algorithmic ones (like UST) can fail.

2. Which stablecoin is safest?

USDC (fully audited) and DAI (decentralized).

3. Can stablecoins replace banks?

Partially—they’re great for transfers but lack credit/loan services.

4. Do stablecoins earn interest?

Yes, via DeFi platforms (e.g., Aave, Compound).

5. Where can I buy stablecoins?

Exchanges like Binance, Coinbase, Kraken.

Conclusion: Master Stablecoins with Biitland.com

Stablecoins are revolutionizing finance, bridging crypto and traditional money. Whether you’re a trader, investor, or DeFi user, understanding them is crucial.